In January, we discussed 2018 Marketing Budget Trends. Today, we examine the basics of calculating your break-even point. This is an important, rather simple metric. But, it is sometimes misunderstand.

Calculating Your Break-Even Point

According to Braden Becker, writing for HubSpot:

“You’ve heard the term ‘break even.’ It’s a popular way to describe a time when you spent exactly as much money as you made. But in a business context, it’s not that simple. Your break-even point needs to be constantly recalculated for you to turn a profit in the long term. Here’s how to find it.”

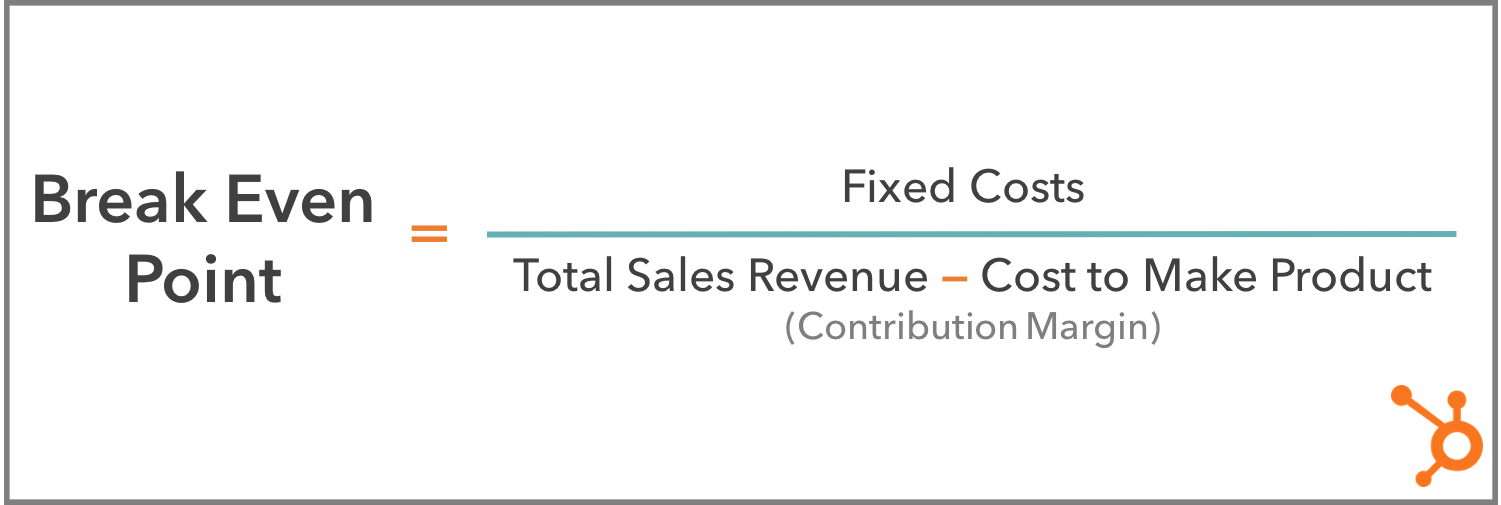

“A business’s break-even point indicates when total revenue from sales will equal total costs to the business. As a formula, your break-even point is your fixed costs divided by your contribution margin. And the final number can be used as a recurring metric by the business to predict profitability. Keep in mind that a break-even point isn’t a finish line. Breaking even is an exciting milestone for a growing business, but the break-even point indicates when the business’s revenue will be equal to its costs — not when it is. Businesses run the equation shown below multiple times a year, eventually surpassing the break-even point and (hopefully) becoming profitable.”

“Why recalculate this number all the time? Once you ‘break even,’ aren’t you officially on the road to profitability? Yes and no. If you calculate your break-even point according to yearly revenue, yearly fixed costs, and yearly contribution margin, then yes, you’d get a number that is more representative of the business’s profitability. Because you’re considering a full year of activity. And once you break even, you wouldn’t have to track your break even point as often. But there are shorter-term break-even points that reset on a weekly, monthly, or quarterly basis to guide you as you strive to reach your end-of-year (EOY) break even point.”

Click the image to read more.